Blog

Pre-Budget Expectation for Real Estate Sector

16 June 2016

The Budget 2016 session will be extremely critical for various sectors and real estate is no different. With sluggish demands, stalled projects, cash crunch, dwindling sales, rising debt levels, high inventory, delayed approvals, and negative consumer sentiment, the real estate sector is hoping for interventions in the budget for increasing buyer confidence & easy financing options.

We are putting forward our expectations for the real estate sector from the Union Budget 2016:

Boost to affordable housing

In spite of the well-publicised figures of the shortage of houses in the affordable housing segment, not many developers have ventured into this space. One of the key reasons has been the thin profit margins in this segment. The profits can be easily eroded with delays in approvals or even fluctuations in prices of raw material prices. This Budget could provide incentives and systems to reduce these risks and attract more developers to this segment.

One of the ways to ensure success for government’s ‘Housing for All by 2022’ target is to provide a much-needed boost to buyers in this segment with cheaper financing options.

Improved infrastructure and connectivity in the peripheral areas of cities where the land costs are relatively less will enable faster development of affordable housing.

Developers in the affordable housing space could be given tax concessions to further boost this sector. Affordable housing can be included under section 80 IB which allows 100% tax exemption along with service tax exemption on housing projects with a certain limit of built up area.

Secure financial interests of home buyers from project delays:

Currently, home buyers who purchase in under-construction properties can claim tax benefits of Rs. 2 lakh post possession if the project was completed within three years. But if the construction is further delayed, the benefits reduce to Rs. 30,000. We want this to be extended to 5 years as often developers face delays in getting approvals.

Improve affordability

We expect the Union Budget to make a provision of allowing home buyers to claim tax benefits from the time they start paying interest on housing loans instead of post-possession. This would considerably reduce the interest burden on them and also facilitate increased home purchases.

Boost Green/Sustainable Real Estate with incentives:

India has so far been a reluctant adopter of the green real estate because home buyers in general, are wary of paying an extra premium for green projects. Low demand for green buildings means developers are not invested in this segment and the Indian real estate has been lagging on this front.

We hope the Budget should encourage developers and home buyers to opt for green projects by providing them with incentives. Buyers need to be convinced of the cost effectiveness and benefits of a green real estate to give a boost to its development.

Industry Status

We sincerely hope this year’s Union Budget would address the demands of the real estate sector for industry status. This’d help developers to avail finances at a lower rate.

Single Window Clearance

We strongly believe a single window clearance can make way for faster project approvals and thereby on-time delivery.

Implementation of RERA

Despite the Union Cabinet approving the Real Estate Development and Regulation Bill last year, it is yet to become a law. The law is expected to boost developer, investor as well as the much-needed buyer confidence by making real estate more transparent & organized. It would attract more FDI and would address the common concerns within the sector. RERA would also make registrations of projects as well as real estate agents mandatory, thereby promoting transparency & accountability and protecting the interests of residential & commercial property buyers.

Minimum Circle Rate

We also hope the Budget would focus on doing away with the provisions that make it compulsory for transactions to happen at minimum circle rates decided by the competent authority. Moreover, the minimum rate should also take into account factors such access to the main road, the shape of the plot, etc. which has a big impact on the value of the land.

Streamlining HRA

While salaried people can claim the deduction for house rent allowance (HRA) as a salary component of their total salary, self-employed persons without an HRA component can only claim a maximum deduction of Rs 2,000 a month under Section 80GG. The Budget needs to boost buyer confidence by addressing this anomaly.

What are your expectations from the Union Budget 2016 for the real estate sector?

TOP Blog

A Note On West Pune’s Infrastructure Developments

12 December 2022

Western Pune includes the suburbs of Baner, Aundh, Balewadi and Hinjawadi among others. Baner and Aund...

Read More

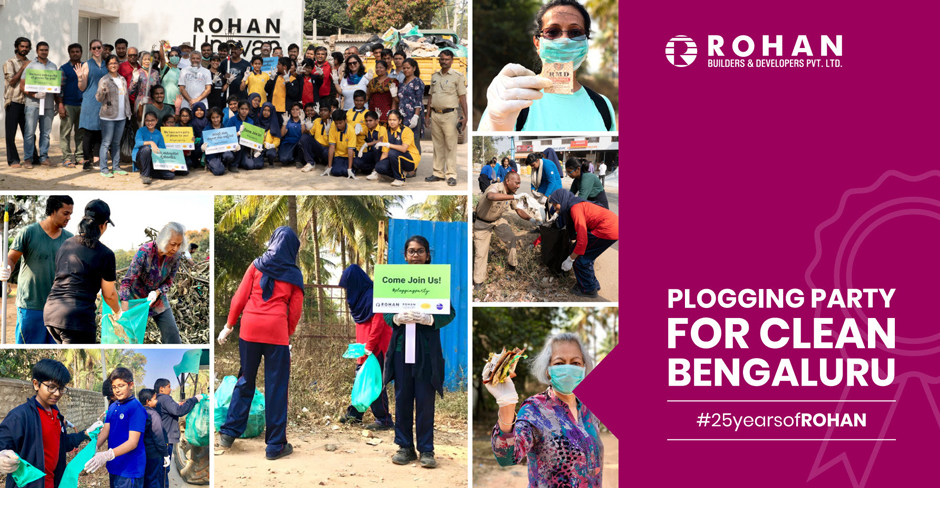

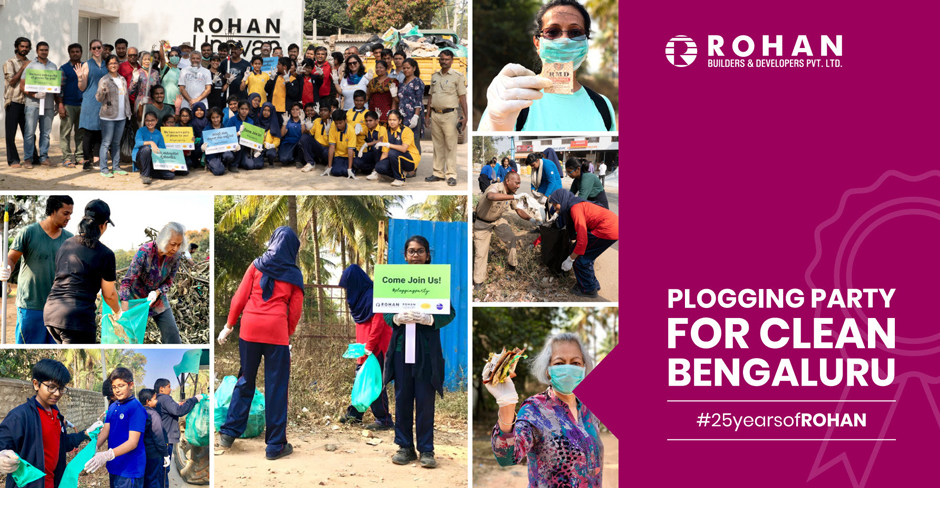

Clean Bengaluru Message by Rohan Builders Plogging Party

20 February 2019

A "Clean Bengaluru" message was unequivocally reaffirmed by Rohan Builders, sixty enthusiastic student...

Read More

Future homes – 3D printing in Construction & Real estate industry.

20 February 2019

Two events, small in bearing yet big on viable impact have occurred very recently in the construction ...

Read More

Hennur Road – The housing location of pride in north Bangalore

27 October 2017

For someone tracking the growth of the city (or megacity) of Bangalore over the years, the last two de...

Read More

A Note On West Pune’s Infrastructure Developments

12 December 2022

Western Pune includes the suburbs of Baner, Aundh, Balewadi and Hinjawadi among others. Baner and Aund...

Read More

Clean Bengaluru Message by Rohan Builders Plogging Party

20 February 2019

A "Clean Bengaluru" message was unequivocally reaffirmed by Rohan Builders, sixty enthusiastic student...

Read More

Future homes – 3D printing in Construction & Real estate industry.

20 February 2019

Two events, small in bearing yet big on viable impact have occurred very recently in the construction ...

Read More

Hennur Road – The housing location of pride in north Bangalore

27 October 2017

For someone tracking the growth of the city (or megacity) of Bangalore over the years, the last two de...

Read More

+91

+91 +672

+672 +82

+82